The insurance world is changing fast. Customer expectations are higher than ever. They want quick, easy, and personalized service. As we look towards 2025, voice AI stands out in its power to meet these demands.

AI Voice for insurance companies and brokers will likely boost customer service, cut costs, and make you richer. So, without further delay, let’s dive into this technology and see how it addresses your needs in the future.

What Exactly is Voice AI for Insurance?

Voice AI for insurance involves using AI to understand and respond to spoken language. Think of intelligent virtual assistants, but tailored specifically for the insurance industry. These aren’t your old, frustrating robotic phone menus. Modern voice AI can hold natural conversations, understand intent, and even detect emotion.

This technology is revolutionizing how AI for insurance companies, AI for insurance brokers, and AI for insurance agencies can interact with clients and manage operations.

Now, let’s explore the top benefits of voice AI for insurance companies.

Customer Experience 24/7/365

One of the most significant impacts of voice AI is on customer service. Imagine your clients getting instant answers to policy questions or starting a claim, any time of day or night, without waiting on hold. Voice AI makes this a reality. It offers 24/7/365 support, handling common inquiries efficiently.

This means your human team is freed up to tackle more complex issues that require a personal touch, leading to higher overall customer satisfaction. Statistics show that AI is expected to handle many customer interactions in 2025, and customers increasingly prefer bots for immediate assistance.

AI for Insurance Claims Gets an Upgrade

The claims process is often a critical touchpoint for customers. It can also be a lengthy and complex one for insurers. Voice AI for insurance claims is a game-changer. It can automate the First Notice of Loss (FNOL), guiding customers through the initial reporting steps smoothly and empathetically.

Some AI companies have even processed and paid simple claims in seconds. This speed and efficiency delights customers during a stressful time and significantly reduces processing costs for insurance companies.

Furthermore, advanced voice AI can help detect preliminary fraud by analyzing vocal patterns during the claims intake.

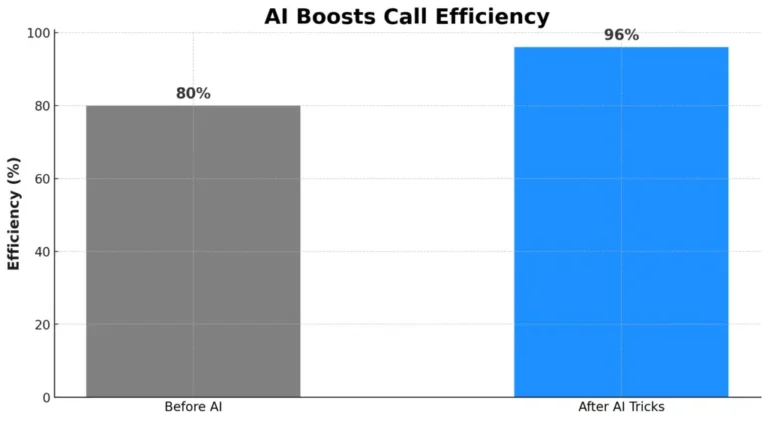

Boosting Operational Efficiency and Reducing Costs

Beyond customer-facing applications, AI for insurance companies brings massive operational benefits. By automating routine tasks like data entry, appointment scheduling, and follow-up calls, voice AI reduces the manual workload on your staff.

This translates directly into lower operational costs—some reports suggest up to a 40% reduction. Agents and brokers can then focus on high-value activities like building relationships, providing expert advice, and complex case management.

Personalization at Scale

Voice AI systems can analyze customer data and interaction history to offer personalized experiences. This could mean suggesting relevant additional coverage (upselling or cross-selling) in a helpful, non-intrusive way or tailoring communication based on individual customer needs and preferences. This level of personalization, driven by AI, helps build stronger customer loyalty and can lead to increased revenue.

Empowering Insurance Brokers and Agencies

The benefits of AI aren’t just for large carriers. AI for insurance brokers and AI for insurance agencies can level the playing field. Voice AI can help smaller operations manage high call volumes, qualify leads effectively, and provide consistent service without needing a massive call center staff. It can automate renewal reminders and follow-ups, ensuring no client slips through the cracks.

Implementing Voice AI: Where to Start?

Insurance companies can integrate voice AI across various touchpoints:

- Customer Service Calls: Handling FAQs, policy information, and payment processing.

- Claims Intake: Automate the FNOL process and provide status updates.

- Sales & Marketing: Qualifying leads, scheduling appointments, and conducting customer satisfaction surveys.

- Internal Support: Assisting agents with information retrieval or internal processes.

Companies like Bigly Sales provide solutions for call centers serving the insurance industry, helping to streamline client acquisition and engagement through various automated communication channels.

While their current focus might be broader sales and marketing automation with SMS and email, including AI call capabilities in their roadmap highlights the growing trend and need for voice AI.

Looking Ahead

Voice AI isn’t standing still. By 2025, it’ll tie into bigger trends—like IoT for live risk tracking or blockchain for secure records. These combos could redefine how we work. Insurance companies that jump in now will set the pace. You’ll meet customer needs better, run leaner, and stay ahead of the pack.

The bottom line? Voice AI for insurance is a must-have. It’s about serving clients faster, smarter, and cheaper. It’s about thriving in a world that’s moving fast. Whether you’re an insurer or a broker, now’s the time to explore this tech. Partners like Bigly Sales can light the way. Don’t wait—2025 is closer than you think.

FAQs – AI Voice for Insurance Companies

Q1) How much does implementing voice AI in an insurance company cost?

The cost of implementing voice AI varies based on your company’s size and your needs. Factors include the number of customer interactions, integration with existing systems, and the level of customization required. However, many providers offer scalable solutions, and the long-term savings from automation and efficiency often outweigh the initial investment.

Q2) Can voice AI integrate with my current insurance software?

Yes, most voice AI solutions are designed to integrate seamlessly with existing insurance software and systems. Tools like AI middleware can help bridge gaps, ensuring that even older systems can benefit from voice AI without requiring a complete overhaul.

Q3) How does voice AI improve customer service in insurance?

Voice AI enhances customer service by providing 24/7 availability, instant responses, and personalized interactions. It handles routine inquiries efficiently, allowing human agents to focus on more complex issues. This leads to faster resolutions, happier clients, and a more competitive edge in the market.

Q4) Is voice AI secure for handling sensitive insurance data?

Absolutely. Reputable voice AI providers prioritize data security and compliance with regulations like GDPR. They use encryption, secure data storage, and regular audits to protect sensitive information. This ensures that customer data remains safe while benefiting from the efficiency of AI-driven interactions.

Q5) What future developments can we expect in voice AI for insurance?

The future of voice AI in insurance is exciting. Expect deeper integration with technologies like IoT for real-time risk monitoring (e.g., smart home devices alerting insurers to potential issues) and blockchain for secure, transparent record-keeping. These advancements will further streamline operations and enhance customer trust.